These are cookies which can be developed by domains which might be unique than ours. These can be employed for internet advertising functions like retaining keep track of of searching functions to show personalised advertisements of goods and providers across a number of Web sites.

He blends information from his bachelor's degree in business finance and his personalized encounter to simplify sophisticated economical subjects. Jordan's promise is actionable assistance that is effortless to understand.

Nevada is recognized for its hospitality and tourism, construction, and wellbeing treatment industries. It does not matter the market, small businesses in Nevada are classified as the spine on the condition’s financial state. And each time a business desires aid, an alternate loan can assist you attain your objectives.

Personalized background, like felony record. Anyone proudly owning much more than twenty% or more of your business need to fill out a sort with their individual information and signal a personal guarantee.

Whilst other loans are usually issued by an SBA lending spouse, just like a bank, and partially assured by the SBA, 504 loans include three parts (as demonstrated inside the image down below):

Thus far, if you need more rapidly funding or don’t Imagine you'll be able to qualify for an SBA 504 loan, you’ll would like to take a look at alternate resources of financing—like brief-phrase loans, business strains of credit history, or other kinds of business loans.

Consider our FAQs For more info regarding how a small business line of credit score with American Specific® will work.

Military veterans make up a very important Component of the small business Neighborhood. We offer revolutionary small business funding solutions, that give veteran-owned businesses the fiscal versatility to mature and prosper.

Credit scores, both equally personalized and business, play a major position in securing financing. Lenders use these scores to assess the chance connected to lending to the startup. Keeping a fantastic credit rating rating can assist you secure far better fascination charges and phrases.

Commonly, prices about the financial institution portion aren’t as low as the CDC costs, and can both be preset or variable. Frequently, these premiums don’t exceed ten% and are sometimes comparable SBA 504 loan nevada to the prices you’d hope to get with a commercial real estate property loan.

All businesses are exclusive and so are matter to approval and evaluate. The demanded FICO rating may be increased based upon your romance with American Express, credit history background, and other aspects.

The long run looks bright for Nevada businesses – and now's enough time to succeed in your business aims with QuickBridge.

As we’ve talked over, nonetheless, although the SBA 504 loan program can be a worthwhile possibility, you will find numerous Functioning pieces to this kind of loan.

Online lenders. Normally, on the net lenders characteristic streamlined purposes and quick funding speeds compared to SBA loans. On the other hand, desire costs are typically higher than All those offered through SBA lenders, and qualification prerequisites can be a lot more rigorous.

Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now! Dawn Wells Then & Now!

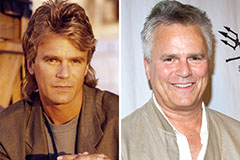

Dawn Wells Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!