SBA loan premiums are a lot of the cheapest available to small businesses, determined by amortization interval and sort of loan request. Charges alter month-to-month on 504 loans, Verify along with your lender for recent fees.

What helps make SBA loans so practical? Initial, the SBA federally backs the loans so that they’re significantly less risky to lenders, making it a lot easier for you to get a loan with reduced interest rates. As well as, they've got different types of SBA loans that all give reduced curiosity costs, low down payments, and prolonged-phrase financing.

When hunting for the proper lender, it is important to take into consideration elements like credit rating specifications, funding amounts, loan terms, charges as well as other capabilities like academic sources.

You typically put together a business program to secure a loan with traditional lenders like banking institutions. Likewise, a business plan might be handy in persuading your family and friends that your business is a worthwhile financial commitment.

Lifestyle insurance coverage doesn’t should be intricate. Obtain reassurance and select the appropriate coverage for yourself.

So it is important to compare lenders as well as their choices to locate the loan most certainly to fit your requires.

In order to use invoice factoring or funding you have to be a firm that invoices other businesses. Why? Since you will probably be advertising All those invoices to a different firm at a discounted amount so you can find funding speedily. The credit of one's purchaser who owes your business money is a lot more significant than you credit rating.

Although business bank cards normally include rewards plans determined by your shelling out, fascination prices accumulate after you have a harmony and insert to the general price of the card.

Standout Added benefits: Fora Financial will allow borrowers to use for additional funding paying off a minimum of 60% of the original loan quantity. Not only will it not demand prepayment penalties, but it provides prepayment savings.

Bankrate’s editorial team writes on read more behalf of YOU – the reader. Our objective would be to give you the most effective information to help you make good particular finance choices. We stick to strict pointers in order that our editorial material is not affected by advertisers.

Who's this for? Kiva is value thinking of in the event you don't need to borrow a large amount of cash. It is a non-profit crowdfunding System that gives microloans of around $15,000 having a mission of unlocking capital for underserved communities.

Seller funding might also allow you to Make business credit history, which in turn can assist your business qualify For extra funding.

As an example, a retired loved one on a set income is often not able to loan funds. Conversely, a pal who's got a effectively-spending work and additional profits could be a better prospect to supply guidance.

Great news! Using the SBA 504 loan software, you can finance business investments with only ten% down. The remainder of the loan will probably be protected by the financial institution and CDC.

Devin Ratray Then & Now!

Devin Ratray Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Karyn Parsons Then & Now!

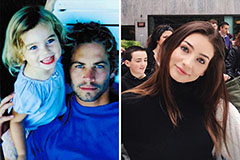

Karyn Parsons Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!